Become a Certified Financial Coach – U.K. ™ certified by International Professional Managers Association (IPMA), UK

The demand for this area is huge and remains unfulfilled in the marketplace in Asia today. There is a vacuum that financial advisors and financial service providers are perhaps not fulfilling yet.

This is primarily because most professionals in this field, whilst having all the knowledge and expertise to help potential clients, however, lack coaching skills. What they need to enhance is a roadmap toward becoming a professional coach.

The future lies in the development of a highly trained and skilful financial coach. The opportunity is tremendous. So be in front of the pack. Be a Financial Coach.

This programme provides an opportunity for financial planners and advisors and others who are involved in advisory roles to acquire another platform with which they can support their existing expertise.

CFC – U.K. is a complementary platform for qualified financial planners and financial advisers as it enhances their ability to add value to clients and potential clients.

IPMA Certified Financial Coach – U.K. ™ Program

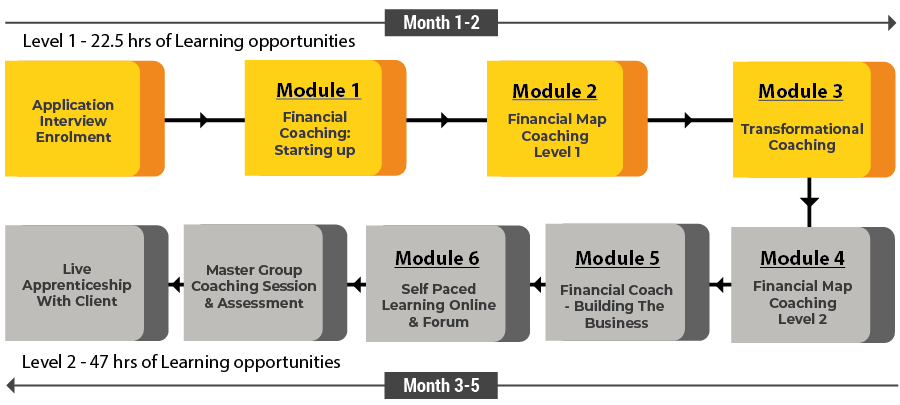

This course is a MENTORSHIP program with international certification from the International Professional Managers Association (IPMA). It consists of 8 Modules:

4-Month MENTORSHIP Program in “69.5 Hours” of Learning including Live Apprenticeship with Client.

Coaching is a professional relationship; you’ll be working with someone who isn’t just going to say “yes” to you. You’ll need to know your client’s needs and be able to serve their interest well. You must also have the ability to help your clients to see the “big picture” of their present and future financial situation without your client having to be bogged down with too many financial details.

Financial coaching is somewhat similar to being a “personal CFO” or “financial doctor” to your clients.

A financial coach is someone who uses the Financial Mapping ™ Coaching Process to help their client figure out how to meet him/her financial goals through an education process that would help them to identify and shortlist specific paths that will lead them to success.

Besides that, the financial coach has to be able to take the client on the journey to help them see the “big picture” view of their financial situation and provide awareness to their client on the financial tools and strategies that are appropriate for the client.

The financial coach must also be able to guide clients to prepare their own financial map and help to prepare the financial plan to serve as a user’s manual to the financial map.

In other words, the financial coach needs to be bonded closely with their client and able to work with their client on financial issues based on the overall situation.

Anyone out there that has been running around in the financial sector will know just how rewarding to be a good financial coach.